Small Business? Canadian Neo Business Banking Compared - Float vs. Venn vs. Loop vs. Keep vs. EQ Bank

Compare Float, Venn, Loop, Keep, and EQ Bank for Canadian small businesses. See pricing, interest rates (up to 4%), FX fees, cashback, and features side-by-side. Venn now offers 2% interest. Find the best neo-banking solution for your business.

'Neo' business banks are transforming how Canadian small businesses handle finances. These digital-first platforms, like Float, Venn, Loop, and Keep, focus on speed, automation, and user-friendly tools, offering features like real-time expense tracking, accounting software integration, and transparent fees. In contrast, EQ Bank, a federally regulated institution, emphasizes stability and regulatory safeguards but lacks the same digital agility.

Key Takeaways:

- Neo Banks: Faster setup, automation, and modern tools tailored to small businesses.

- EQ Bank: Stability and deposit insurance but less emphasis on digital innovation.

- Keep: High credit limits, fast approvals, and no-fee global banking stand out for growth-focused businesses.

Quick Comparison:

Banking Option | Strengths | Weaknesses |

|---|---|---|

Float | Digital platform, efficient processes | Limited public details, newer market presence |

Venn | Automation, accounting integration | Short track record, feature gaps |

Loop | User-friendly, digital-first | Fewer traditional banking options |

Keep | High credit limits, fast approvals, global banking | Fees for unpaid balances |

EQ Bank | Stability, deposit insurance | Less advanced digital tools, opaque fees |

Choosing the right partner depends on your business priorities - whether you value modern tools or regulatory stability. Keep reading for a deeper dive into each option.

Detailed Pricing & Interest Rate Comparison

Here's where these accounts truly differ - in the fees you'll pay and the interest you'll earn. Understanding these differences can save your business thousands of dollars annually.

Free Plans Comparison

| Feature | Float Essentials | Venn Essentials | Loop Basic | Keep | EQ Bank Business |

|---|---|---|---|---|---|

| Monthly Fee | $0 | $0 | $0 | $0 | $0 |

| Interest Rate | Up to 4% | 2%** (New!) | 0% | 0% | 2.25% |

| FX Fees | 2.5% | 0.45% | 0.50% | 3% on intl cards | Standard bank rates |

| Cashback | No | 1% (capped at $5K/month spend) | No | Up to 4X | No |

| Free e-Transfers | Unlimited | Unlimited | Included | Included | 50 outgoing/100 incoming |

| Multi-currency | CAD + USD | CAD, USD, GBP, EUR | CAD, USD, GBP, EUR | Yes | CAD only |

| Credit Offering | No | No | Up to $50K CAD | Up to $400K+ | No |

| Accounting Integration | Yes (QBO, Xero) | Yes (QBO, Xero) | In development | Yes (QuickBooks) | No |

| Physical Cards | Up to 20 | Unlimited | Included | Included | No (coming 2025) |

**Venn just launched 2% interest on all CAD and USD balances (November 2025) with no minimums or caps, making it competitive with EQ Bank while offering superior FX rates and cashback.

Paid Plans Comparison

| Feature | Float Professional | Venn Plus | Venn Pro | Loop Plus | Loop Power |

|---|---|---|---|---|---|

| Monthly Fee | $10 CAD/user (min $100) | $40 CAD | Custom | $79 CAD | $299 CAD |

| Interest Rate | Up to 4% | 2% | 2% | 0% | 0% |

| FX Fees | 2.5% | 0.35% | 0.25% | 0.25% | 0.1% |

| Cashback | No | 1% (capped at $25K/month) | 1% unlimited | No | No |

| Free e-Transfers | Unlimited | Unlimited | Unlimited | Included | Included |

| Multi-currency | CAD + USD | CAD, USD, GBP, EUR | CAD, USD, GBP, EUR | CAD, USD, GBP, EUR | CAD, USD, GBP, EUR |

| Credit Offering | Enhanced | Enhanced | Enhanced | Up to $50K CAD | Up to $50K CAD |

| Accounting Integration | Yes (QBO, Xero, NetSuite) | Yes (QBO, Xero) | Yes (QBO, Xero) | In development | In development |

| Physical Cards | Unlimited | Unlimited | Unlimited | Included | Included |

| Best For | Teams 10+ users | Growing businesses | High-volume FX | Mid-tier needs | Lowest FX fees |

Note: Float also offers an Enterprise plan with custom pricing. Venn's Pro plan pricing is custom based on business needs.

The Best Business Bank Accounts in Canada

1. Float

Float is a digital-first bank tailored for Canadian small businesses and startups. However, publicly available information about its account features, fee structure, and integration options is somewhat limited.

Details about Float's online account setup process, security protocols, and compatibility with Canadian accounting software aren't readily accessible. To get a clear picture of its services and ensure they meet your needs, it's best to visit Float's official website for the most up-to-date information on its offerings and compliance standards.

Next, let's take a look at what Venn brings to the table and how it compares.

Pricing & Key Features

Monthly Fees: $0 - Float offers a free Essentials plan with no monthly charges.

Interest Rate: Up to 4% on business account balances - the highest among all options compared. This is approximately 2.8x higher than traditional business savings accounts and significantly outperforms most neo banks that offer 0%.

Foreign Exchange: 2.5% FX fee on foreign currency transactions (increased from 1.5% in 2022).

Unique Benefits:

- CDIC insurance up to $100,000 plus 100% protection for funds held in trust accounts

- Automated receipt collection and matching

- Integration with QuickBooks and Xero

- Bill payments via wire transfer, no-fee EFT & ACH

- CAD and USD accounts in a single platform

- Interac e-Transfer with 1-business-day funding

Float's combination of zero fees and market-leading interest makes it particularly attractive for businesses maintaining significant cash balances.

2. Venn

Venn is a digital bank designed to simplify financial management for Canadian small businesses. It focuses on making everyday transactions smoother and integrates smart tools to help businesses stay efficient. This aligns with the broader trend of neo banks offering digital-first services centred on convenience and automation.

Account Features

Venn offers features like automated transaction categorization and integration with popular accounting platforms. Businesses can handle their finances through both mobile and web platforms, reducing the burden of administrative tasks thanks to automation. By connecting seamlessly with leading Canadian accounting software, Venn ensures businesses can maintain accurate financial records and generate reports without extra effort.

What sets Venn apart is its focus on automating workflows and its strong emphasis on accounting software integration, which differentiates it from traditional banks and many other neo banks.

Pricing & Key Features

Monthly Fees: $0 - Venn offers completely free business banking with no monthly charges.

Interest Rate: 0% - While Venn doesn't currently offer interest on account balances, it compensates with exceptional cashback and FX rates.

Cashback: 1% unlimited cashback on all corporate card purchases - one of the best cashback rates available for Canadian business cards.

Foreign Exchange: 0.25-0.45% FX fees depending on plan tier - the lowest FX fees among all neo banks compared. This is 6-12 times lower than Keep's 3% and significantly better than Float's 2.5%.

Unique Benefits:

- Real local CAD, USD, GBP, and EUR accounts (not just currency conversion)

- Unlimited free Interac e-Transfers

- Two-way QuickBooks and Xero sync

- Built-in invoicing with OCR receipt capture

- Accounts payable automation

- CDIC protection through tier 1 banking partners

- Per-account pricing (not per-user), so costs don't increase as team grows

- Free unlimited corporate cards for team members

Venn excels for businesses needing multi-currency capabilities combined with the industry's best FX rates and unlimited cashback.

Next, let’s explore how Loop approaches business banking in Canada.

3. Loop

Pricing & Key Features

Loop offers tiered pricing plans to suit different business needs:

Loop Basic: $0/month

- 0.50% FX fee

- Credit limits up to $50,000 CAD

- Free international payments

Loop Plus: $49 CAD/month (or $79 CAD as of 2025)

- 0.25% FX fee

- Credit limits up to $50,000 CAD

- Enhanced features

Loop Power: $199 CAD/month (or $299 CAD as of 2025)

- 0.1% FX fee - competitive with Venn

- Credit limits up to $50,000 CAD

- Premium features

Interest Rate: 0% - Loop does not currently offer interest on account balances.

Unique Benefits:

- CAD, USD, GBP, and EUR account support

- Free international wire transfers (a $10 fee at some competitors)

- No foreign transaction fees when spending in supported currencies

- CDIC protection for eligible deposits up to $100,000

- Credit card that automatically scales based on business performance

- User-friendly digital-first platform

Note: Loop's accounting integrations with QuickBooks and Xero are currently in development and not yet available.

Loop is ideal for businesses that need multi-currency capabilities and are willing to pay a monthly fee for lower FX rates, though the free Basic plan offers solid value for budget-conscious businesses.

Next, let’s take a closer look at what Keep has to offer.

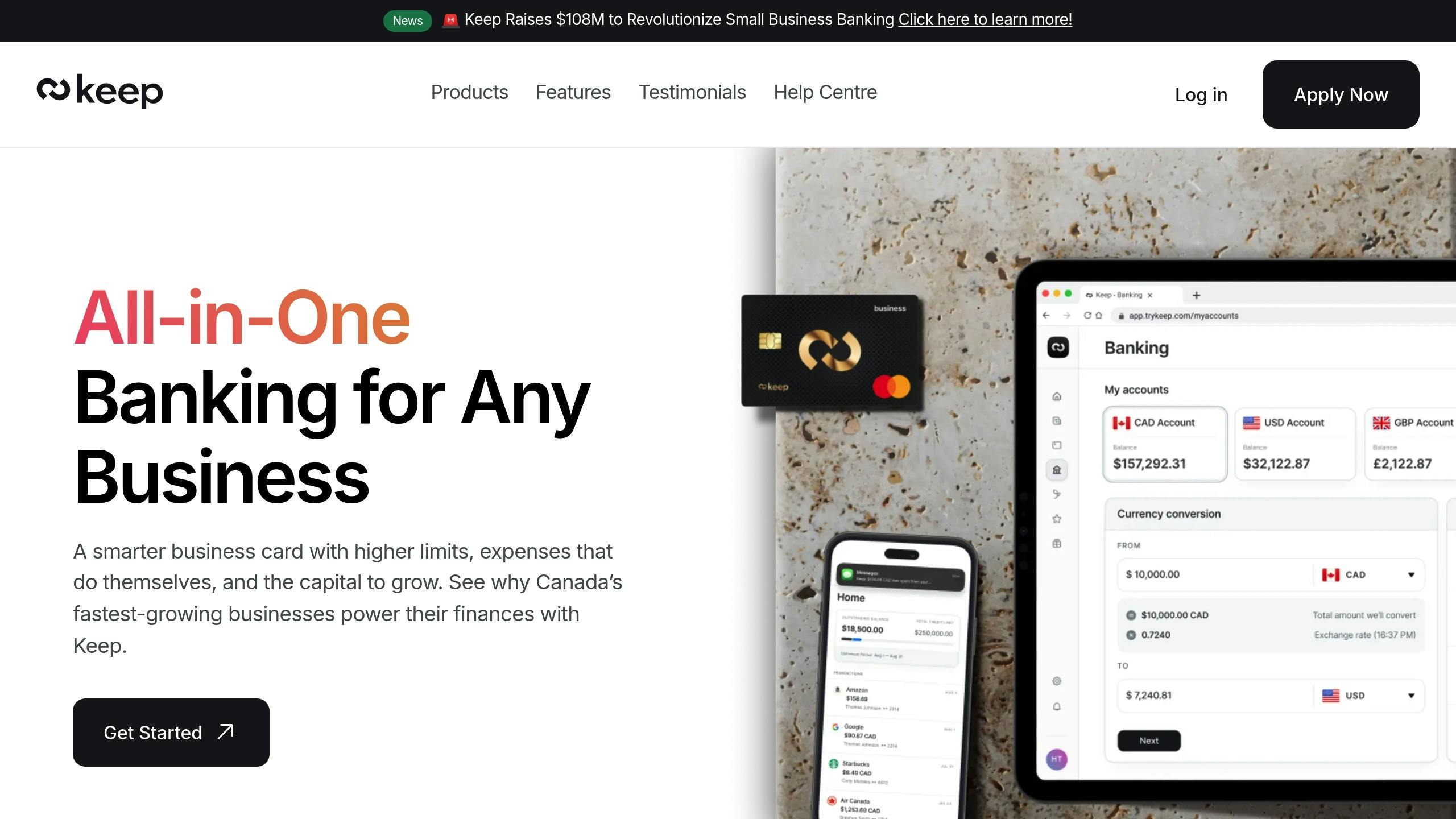

4. Keep

Keep is a comprehensive financial platform tailored for Canadian small businesses. With $108 million raised, more than 5,000 companies served, and over $90 million processed through its Keep Card, it’s quickly becoming a go-to solution for business banking in Canada.

Account Features

One of Keep's standout offerings is its 4X Rewards Business Credit Card, which comes with credit limits up to 10 times higher than those of traditional banks. The platform also provides virtual cards, giving businesses a secure and efficient way to manage spending. The application process is quick - just 8 minutes - and approvals are completed within 72 hours without impacting your credit score.

For businesses seeking funding, Keep offers Growth Capital financing of up to $1 million. The terms are transparent, with no hidden fees, making it a less stressful alternative to traditional banking systems. Additionally, Keep supports no-fee global banking, allowing businesses to make deposits and international payments in over a dozen currencies at mid-market exchange rates. This feature is especially beneficial for companies involved in cross-border trade.

Fees and Cost Structure

Keep promotes a "$0 No hidden fees" policy for its core services, including the rewards credit card, Growth Capital, and global banking. However, businesses should note that fees apply if credit card balances aren’t paid in full each month.

Support for Canadian Businesses

Keep has built a reputation for supporting Canadian small businesses through its innovative products and customer-first approach. Testimonials from users highlight its impact on business growth and ease of use. For instance, one business owner shared:

"Keep has been a godsend to my company for almost one year now. Keep was able to bring my company from an average of maybe $800,000 per year in sales to almost $3,000,000 this year." - John E.

Automation and Integrations

Keep simplifies expense management with robust automation tools. Businesses can track expenses in real time, upload receipts, create custom spending rules, and integrate seamlessly with QuickBooks for faster reconciliation and bookkeeping.

The platform’s continuous updates and responsive support have also been praised by users. One customer shared their experience with a technical issue:

"I had an issue that seemed to be a software glitch. When I addressed this issue, I was greeted with a team that truly wanted to help me resolve the problem. When their direction did not work, I was told that they would work with their IT department to get to the bottom of it, and they did!" - Gabriel M.

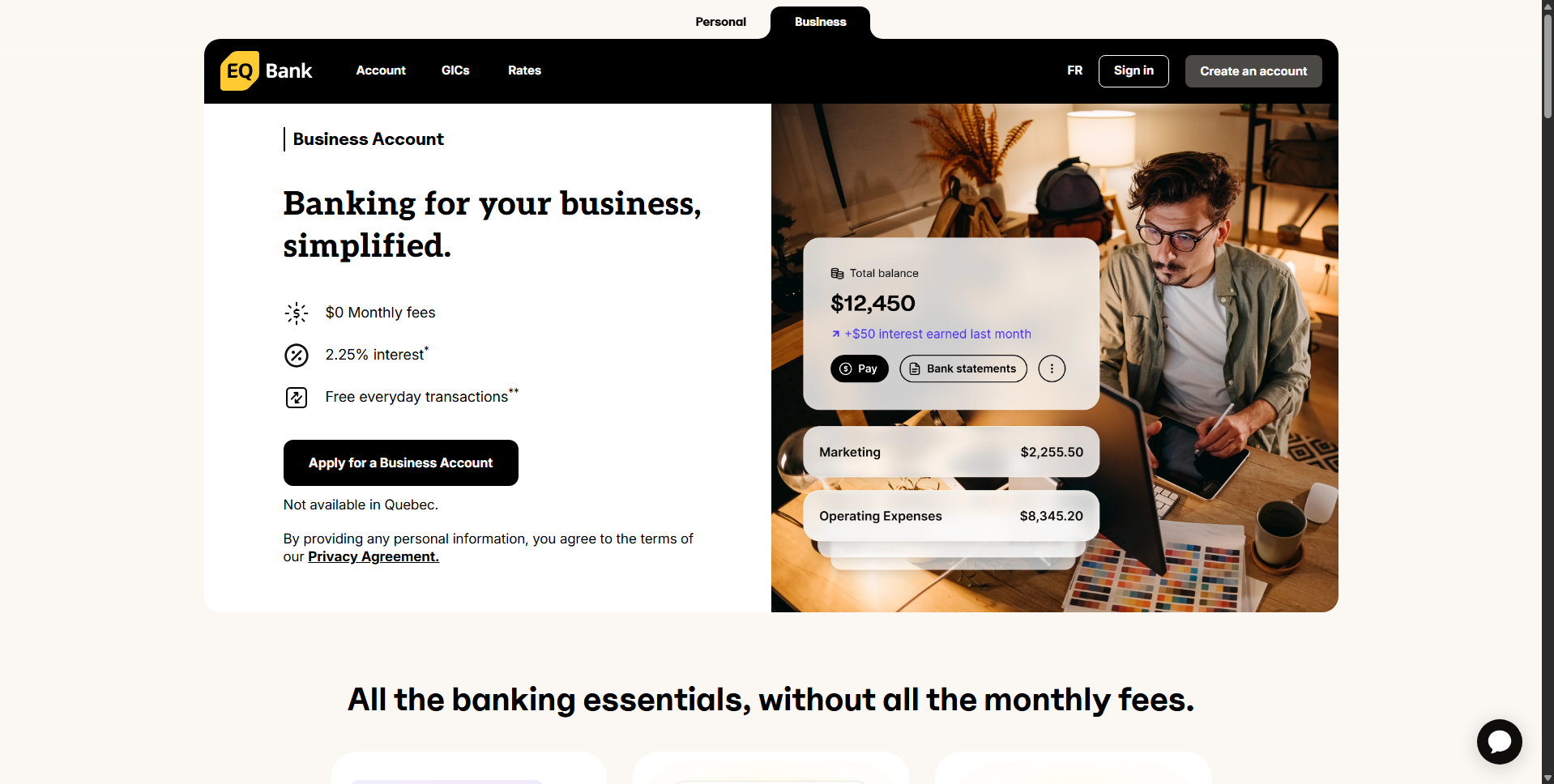

5. EQ Bank

EQ Bank stands out as a more traditional option compared to the modern, tech-driven approach of neo banks. As a federally regulated institution, it offers the reassurance of established regulatory safeguards and a focus on stability.

Account Features

The EQ Bank Business Account is designed specifically for small businesses across Canada (except Quebec). It offers essential banking features with a competitive interest rate and no monthly fees.

Key Features:

- Up to 10 sub-accounts to categorize funds for taxes, daily expenses, and more

- Automated bill payments - schedule vendor payments with unlimited free bill payments and EFTs

- 50 free outgoing and 100 free incoming Interac e-Transfers per month ($0.50 per transaction thereafter)

- Free tax payments - pay business taxes online directly from the account

- Mobile cheque deposit at no charge

- Quick online application - skip the branch and apply online in minutes

Fees and Cost Structure

Unlike the straightforward, low-fee models often seen with neo banks, EQ Bank's fee structure can be less transparent. It may include monthly maintenance fees or transaction limits. To understand the full picture, it’s recommended to contact EQ Bank directly.

Monthly Fees: $0 - No monthly account fees, and no minimum balance requirements.

Interest Rate: 2.25% (calculated daily on the total closing balance and paid monthly) - This is significantly higher than the 0% offered by most neo banks and competitive with Float's up to 4%.

Transaction Fees:

- Interac e-Transfers: 50 free outgoing, 100 free incoming per month ($0.50 each thereafter)

- Electronic Funds Transfers (EFTs): Free

- Bill Payments: Free

- Mobile cheque deposits: Free

Comparison vs. Big 5 Banks: Traditional banks charge up to $20/month and may require minimum balances to waive fees. EQ Bank's free Business Account with 2.25% interest represents significant savings - potentially thousands of dollars annually for businesses maintaining average balances.

CDIC Protection: As a federally regulated bank (Canada's 7th largest), EQ Bank provides CDIC insurance coverage for eligible business deposits up to $100,000. This offers security and peace of mind that neo banks operating through partnerships may not directly provide.

Dedicated Support: Business Banking Specialists are available via phone or online chat 7 days a week, 8 AM to midnight EST, providing Canada-based expert support when needed.

Trusted by Over 500,000 Canadians: EQ Bank has established credibility with a substantial customer base and proven track record in digital banking.

Limitations:

- CAD only - No multi-currency support (unlike Venn, Loop, or Keep)

- No corporate cards - A corporate card is planned for 2025 but not yet available

- No accounting integrations - Unlike neo banks, no direct QuickBooks or Xero sync

- Not available in Quebec

EQ Bank Business Account is ideal for businesses that prioritize earning interest on cash balances, want CDIC protection, and operate primarily in CAD without needing multi-currency or advanced fintech features.

For businesses that value a traditional banking experience with strong regulatory backing, EQ Bank could be a suitable choice. Be sure to consult with them to fully understand their features, fees, and support options.

Advantages and Disadvantages

Let’s take a closer look at the strengths and weaknesses of each banking option. The choice between neo banks and traditional banks often comes down to what your business values most - whether it's cutting-edge technology and convenience or long-standing stability and regulatory assurance.

Neo banks, such as Float, Venn, Loop, and Keep, shine when it comes to digital innovation and user-friendly design. These platforms are built with modern technology, offering sleek interfaces, automated tools, and faster approval processes. They also tend to have transparent pricing, making it easier for businesses to understand costs upfront. However, the trade-off is their relatively short track record. Since they’re newer to the market, they haven’t been tested as thoroughly during economic challenges or regulatory shifts.

Among neo banks, Keep stands out. With over $108 million raised, it’s trusted by more than 5,000 Canadian businesses and has processed over $90 million through its Keep Card. It offers high credit limits and quick approvals, making it appealing for businesses needing fast access to funds. But there’s a catch: if a business doesn’t pay its balance in full each month, the fees can add up quickly. This makes Keep less ideal for companies that rely on carrying a balance or have irregular cash flows.

On the other hand, EQ Bank, a traditional banking option, offers the security of federal regulation and deposit insurance. For businesses that prioritize stability and risk management, this can be a big draw. However, EQ Bank’s fee structure is less transparent, and its digital features may not be as advanced as those offered by neo banks.

Here’s a quick comparison of the key strengths and weaknesses of these options:

Banking Option | Key Strengths | Main Weaknesses |

|---|---|---|

Float | Intuitive digital platform, efficient processes | Limited regulatory history, newer in the market |

Venn | Advanced tech features, automation | Shorter track record, possible feature gaps |

Loop | Digital-first with user-friendly tools | Fewer traditional banking options, newer platform |

Keep | High credit limits, fast approvals, strong customer support | High fees for unpaid balances; rewards system could improve |

EQ Bank | Federal regulation, deposit insurance, long-standing stability | Opaque fee structures, less advanced digital tools |

Another key factor is customer service and approval speed, which vary significantly between platforms. Neo banks often emphasize quick approvals and transparent fee models but can impose steep penalties for unpaid balances. Meanwhile, traditional banks like EQ Bank may have hidden fees and slower processes but offer broader international banking relationships and services.

When it comes to international capabilities, neo banks often excel at handling multi-currency accounts and global payments. However, traditional banks might provide more extensive international banking options, though usually at a higher cost.

This breakdown helps highlight which banking solution aligns best with your business priorities, whether that’s cutting-edge tools or tried-and-true stability.

Best Options for Different Business Types

Choosing the right banking platform depends heavily on your business's unique needs. Every business type faces its own set of challenges, from managing irregular cash flows to dealing with international transactions. Based on the comparison above, here’s a breakdown of the best options tailored to specific business types, highlighting how their features align with operational demands.

Solo Entrepreneurs

Solo entrepreneurs often juggle multiple responsibilities, making administrative efficiency a top priority. Keep simplifies this with its all-in-one expense management platform. It automates expense tracking, uploads receipts, and applies custom rules to speed up bookkeeping. Plus, the onboarding process is quick - just 8 minutes to apply for a Keep Business Mastercard.

Kyle H., who owns a small tree company, shared his experience:

"I was skeptical too, but instead after I applied I really was approved in just hours. I own a small tree company and they gave me a credit card for 4x what RBC would do and RBC required 10x as much paperwork." - Kyle H.

Keep’s integration with QuickBooks also ensures seamless syncing of expenses, making tax season far less stressful.

Tech Startups

Tech startups often deal with rapid growth and evolving financial needs. Keep caters to these challenges by offering growth capital of up to $1 million and credit limits up to 10x higher than traditional banks. These features provide startups with the financial flexibility to scale quickly.

Agencies and Service-Based Businesses

For agencies and service-based businesses, tracking expenses and managing team spending are key. Keep’s platform offers unlimited virtual cards with individual spending limits and real-time monitoring. This allows businesses to set card limits, freeze cards instantly when needed, and keep a close eye on expenses as they happen.

E-commerce Businesses

E-commerce businesses, which often work with international suppliers and multiple payment processors, benefit from Keep’s no-fee global banking. The platform supports over a dozen currencies and enables international payments at mid-market exchange rates. Its virtual card system allows businesses to assign separate cards for each supplier or advertising platform. With over 5,000 Canadian companies processing more than $90 million through Keep Card, the platform demonstrates its ability to handle high transaction volumes.

Small and Medium Enterprises (SMEs)

SMEs often look for stability and comprehensive banking solutions. While traditional banks like EQ Bank offer federally regulated services and deposit insurance, many SMEs find Keep’s enterprise-level features more aligned with their needs. Keep combines credit, expense management, and payment solutions into one platform, making it easier for businesses to scale. For those hesitant about newer platforms, Keep’s $108 million in funding is a testament to its stability and growth potential.

International Businesses

For companies operating across borders, managing currencies and international transactions efficiently can result in significant cost savings. Keep offers mid-market foreign exchange rates and the ability to transact in multiple local currencies, reducing the fees associated with traditional wire transfers and currency conversions. While Keep excels in providing innovative solutions for international businesses, EQ Bank remains a solid choice for those prioritizing regulatory security and stability.

Conclusion

Finding the right banking partner for your Canadian small business is all about understanding your unique needs and where your business is headed. The banking world has evolved significantly, with neo banks stepping in to offer solutions that traditional institutions often struggle to keep up with. Among these, Keep stands out for its digital-first approach and support for growing businesses.

When it comes to affordable access to growth capital, Keep shines with its modern credit and card options, supported by strong financial backing. Gabriel M., a Keep customer, shared his experience:

"Extremely grateful for the Keep team, which has supported my business with an easy to manage credit card system for my team, as well as reasonable terms for repayment if I use more than I can pay right away."

Quick access to credit is another major advantage in today’s fast-moving business world. Traditional banks often involve long approval processes and heavy paperwork, but Keep simplifies this with an online application that can deliver approvals in just hours. This is a game-changer for businesses juggling cash flow or needing to act on time-sensitive opportunities. For companies with international operations, Keep also offers no-fee global banking services, supporting over a dozen currencies and providing mid-market foreign exchange rates - helping businesses save significantly compared to traditional banking fees.

However, this flexibility comes with responsibility. Disciplined payment practices are essential to avoid unnecessary fees. As Ronice H., another Keep customer, noted:

"Great experience. Got approved for $4,000 right away. Fees can be steep if the balance isn't paid in full each month, but the most flexible card I have ever used."

Ultimately, the best choice depends on your business's current needs and future ambitions. Established businesses might prefer the stability of traditional banks, while growth-focused companies could thrive with the agility and innovation of neo banks like Keep. Take a close look at your banking costs, credit requirements, and operational priorities to find the solution that sets your business up for success in Canada.

FAQs

What sets Canadian neo banks like Float, Venn, Loop, and Keep apart from a traditional option like EQ Bank for small businesses?

Neo banks like Float, Venn, Loop, and Keep are built to meet the needs of modern businesses. They offer features such as corporate cards, expense management tools, and quick setup processes. With lower fees and tech-forward financial solutions, these platforms are especially attractive to small businesses aiming for a streamlined banking experience.

In contrast, EQ Bank provides a traditional business account that remains competitive. It comes with perks like no monthly fees, interest on deposits, and free transactions, including Interac e-Transfers and bill payments. As a regulated bank, EQ Bank offers the stability and security that some businesses prioritize.

Choosing between the two depends on what your business values most. Neo banks are great for businesses looking for flexibility and modern tools, while EQ Bank suits those who prefer simplicity and dependable service.

How can Keep’s high credit limits and global banking features support Canadian businesses in international trade?

Keep offers high credit limits that allow Canadian businesses to manage larger transactions with ease. This feature is especially useful for handling substantial international deals, removing potential financial barriers. On top of that, its global banking features streamline cross-border trade by supporting multiple currencies. This reduces the complications of currency conversions and ensures seamless international payments and receipts. For businesses aiming to grow their global presence while keeping financial operations flexible, Keep stands out as a solid choice.

What should small businesses in Canada consider when choosing between a neo bank and a traditional bank?

When weighing the choice between a neo bank and a traditional bank in Canada, small businesses should pay close attention to factors like fees, features, and security. Neo banks often stand out with lower or even zero monthly fees, quicker application processes, and modern tools like expense tracking or accounting software integrations. On the other hand, traditional banks might appeal to businesses seeking more extensive customer support and the familiarity of long-established institutions.

Key considerations include whether the bank provides interest on balances, low transaction fees for Interac e-Transfers or EFTs, and CDIC insurance to protect deposits. If your business handles foreign currencies, competitive foreign exchange rates can also be a deciding factor. Ultimately, the best choice will depend on your specific needs - whether you're prioritizing cost efficiency, access to advanced features, or the peace of mind that comes with a regulated, traditional banking option.